Once the accounts have been activated, you’ll see your account details under each currency.Ĭopy your account details from your Wise account (make sure that you select the correct currency). If you wish to add more currencies, click on ‘Open a balance’ from the ‘balances’ page. You’ll have to choose which currency to activate first. Once the account is ready, go to ‘balances’ and click on ‘get started’. Here’s how you can connect your Wise account with PayPal However, once you've collected the payments to your PayPal account, you have the option to withdraw the money to your Wise account to avoid the PayPal conversion fee. Even though the service has costs, it comes with necessary features, especially if you have your own website and need a payment gateway to process credit card payments. If you collect payments from your website, PayPal is a reliable payment gateway.

On the other hand, Wise charges $5.21 for the same transaction, so you can save around $28 on fees.Ĭonnect your PayPal Merchant Account to lower invoice fees For example, withdrawing €1000 to your USD account will cost around $33 with PayPal. If you have to convert the collected funds through PayPal, there would be an additional fee of 3.0%. Once you’ve received the funds to your PayPal account, you’ll need to somehow withdraw them to your local bank account.

This can save hours on admin when managing invoices.īut it's not only the receiving fee that you need to consider when collecting PayPal invoice payments.

DOES PAYPAL CHARGE A FEE SOFTWARE

Wise Business integrates with invoicing software such as QuickBooks to take advantage of other features the tool offers. Simply add your local account details with Wise to easily collect payments.

DOES PAYPAL CHARGE A FEE DOWNLOAD

You can also download a free invoice template. With the Wise Business account, you can receive payments in 10 major currencies such as EUR, GBP, NZD, AUD, and PLN like a local.

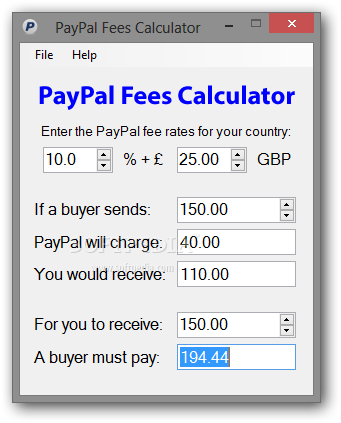

One way to avoid the currency conversion fees set by PayPal is to use the Wise Business account to receive or convert your international payments. How do I send an invoice on PayPal without fees? Avoid PayPal invoice fees with Wise Business You can calculate how much PayPal will charge you with this simple PayPal fee calculator from Wise. The receiver (your business) is responsible for these fees, which are automatically deducted. If you wish to convert the received payments to your local currency, the set rate is 3.0% above the base exchange rate.³ There’s also an additional 1.50% rate for international transactions, and a fixed fee based on the currency you received. So, what percentage does PayPal take from invoices?Ĭollecting invoice payments to your PayPal account incurs a 3.49% charge and a $0.49 flat fee per transaction if it's within the US.²įor payments from other countries, there’s the same 3.49% transaction fee. With ease - Try Wise Business PayPal Invoice feesĪlthough it is free to send and manage online invoices with PayPal, you'll have to pay a fee once you get paid.¹ Read on to discover the PayPal invoice fee breakdown and ways you may be able to avoid this fee. It’s worth knowing what these fees will be before you start using PayPal invoicing. However, PayPal does charge fees for business owners to receive invoice payments. There are no subscription fees for sending or managing online invoices. Travelling to Australia Austria Bangladesh Belgium Brazil Bulgaria Canada Chile China Colombia Croatia Cyprus Czech Republic Denmark Egypt Estonia Finland France Georgia Germany Greece Hong Kong Hungary India Indonesia Ireland Israel Italy Japan Kenya Latvia Liechtenstein Lithuania Luxembourg Malaysia Malta Mexico Monaco Morocco Nepal Netherlands New Zealand Nigeria Norway Pakistan Peru Philippines Poland Portugal Romania Russia San Marino Singapore Slovakia Slovenia South Africa South Korea Spain Sri Lanka Sweden Switzerland Thailand Turkey Ukraine Vietnam The UAE The UK The US.Life in Australia Austria Belgium Brazil Canada China Croatia Cyprus Czech Republic Denmark Finland France Germany Greece Hong Kong India Indonesia Ireland Israel Italy Japan Luxembourg Malaysia Malta Mexico Netherlands New Zealand Nigeria Norway Pakistan Peru Philippines Poland Portugal Russia Singapore South Africa South Korea Spain Sweden Switzerland Thailand Vietnam The UAE The UK The US.

0 kommentar(er)

0 kommentar(er)